Sweden Bike Sharing Industry Outlook (2024–203: Trends by Model, Type & Region

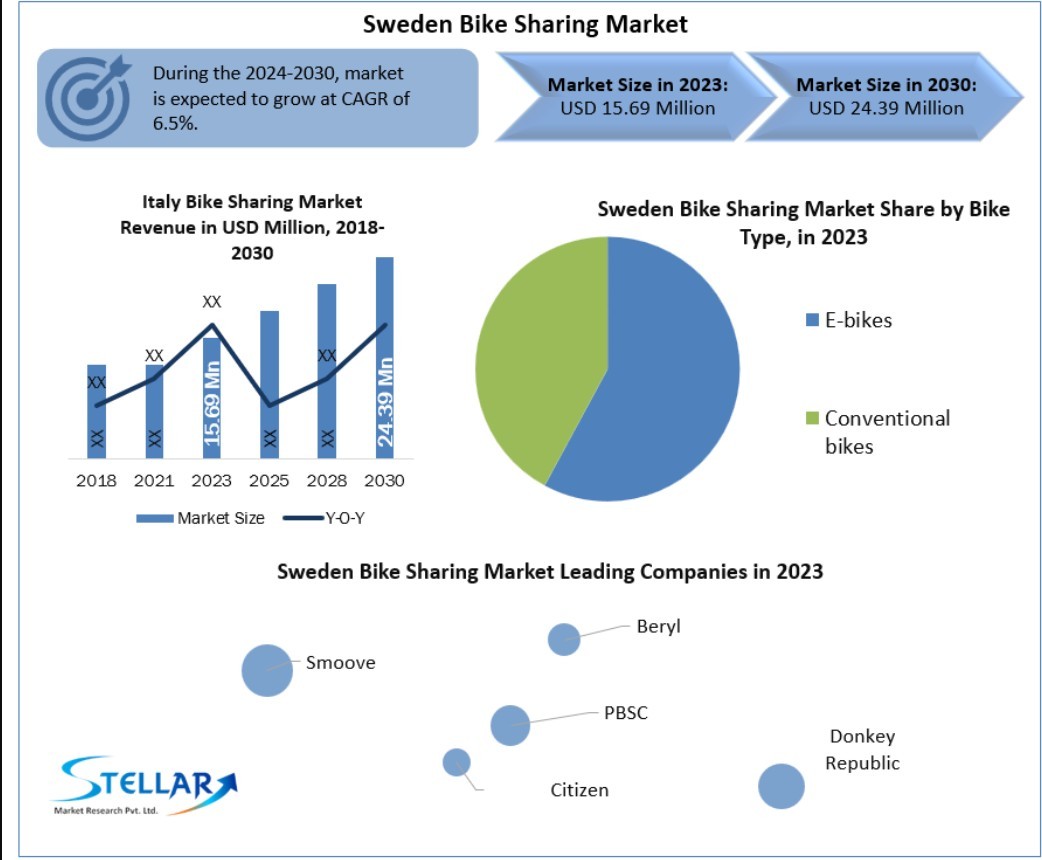

Sweden Bike Sharing Market size was valued at US$ 15.69 Million in 2023 and the total Sweden Bike Sharing Market revenue is expected to grow at 6.5% through 2024 to 2030, reaching nearly US$ 24.39 Million during the forecasting period (2024- 203. This surge is attributed to Sweden’s strong push towards sustainable urban transport, advanced digital infrastructure, and widespread public support for green commuting solutions.

Free Sample Copy: https://www.stellarmr.com/repo....rt/req_sample/Sweden

1. Market Estimation & Definition

The Sweden Bike Sharing Market comprises the systems and services that enable the rental of bicycles, typically on a short-term basis, in urban environments. These services include docked and dockless bike-sharing programs, often operated through mobile applications that provide real-time bike location, booking, and payment options.

With increasing urban congestion and environmental concerns, bike sharing has emerged as a vital component of Sweden’s multimodal transportation strategy. Public-private collaborations, integration with public transport, and emphasis on active mobility are driving the nationwide adoption of shared cycling systems.

Free Sample Copy: https://www.stellarmr.com/repo....rt/Sweden-Bike-Shari

2. Market Growth Drivers & Opportunities

1. Government Sustainability Initiatives

Sweden is one of the global leaders in carbon-neutral mobility. The Swedish government’s climate policy framework encourages the development of cycling infrastructure, subsidized bike-sharing programs, and smart city integration. National and municipal grants have incentivized local governments and tech firms to expand bike-sharing stations.

2. Urbanization and Congestion Mitigation

With more people moving into urban centers like Stockholm, Gothenburg, and Malmö, there is increasing pressure on traditional transit systems. Bike sharing provides a last-mile connectivity solution, particularly for commuters traveling between transit hubs and workplaces.

3. Rising Health & Environmental Awareness

Post-pandemic, there has been a shift in consumer behavior toward personal, contactless, and healthy modes of transport. Biking not only reduces carbon emissions but also contributes to improved public health, which aligns with Sweden’s national wellness goals.

4. Integration with Smart Mobility Ecosystems

Bike sharing in Sweden is now a part of integrated mobility platforms (like Whim and UbiGo), allowing users to plan, book, and pay for multiple transport modes (bike, bus, train) via a single app. This Mobility-as-a-Service (MaaS) trend is creating a seamless user experience and boosting bike usage rates.

5. Tech Advancements and E-Bike Adoption

The rollout of electric bikes (e-bikes) in sharing fleets is enhancing the system’s usability, especially in hilly or long-distance areas. GPS-enabled tracking, IoT-based fleet monitoring, and smart locks are ensuring secure, efficient operations and higher fleet availability.

3. Segmentation Analysis (Based on Stellar Market Research)

According to the report, the Sweden Bike Sharing Market is segmented by Bike Type, Sharing Type, and Region.

By Bike Type:

Traditional Bike

E-bike

E-bikes are the fastest-growing segment due to their ease of use, especially for longer commutes and diverse terrain. They are favored by older users and casual riders. Traditional bikes still hold a significant share in urban cores and campus-based systems due to cost-effectiveness.

By Sharing Type:

Docked

Dockless

Dockless bike sharing dominates the market in Sweden, thanks to the flexibility it offers users. However, docked systems are more prevalent in government-backed projects where regulation and orderliness are a priority. Dockless bikes, deployed by private players, have quickly scaled in metro areas.

By Region:

North Sweden

South Sweden

East Sweden

West Sweden

South Sweden, including Malmö and Gothenburg, is leading in terms of adoption due to strong infrastructure and policy support. West and East Sweden are catching up, with pilot bike-sharing programs being launched in smaller cities and university towns.

4. Country-Level Analysis

United States:

The U.S. bike sharing market offers valuable comparisons and lessons for Sweden. Major cities like New York, San Francisco, and Washington D.C. have embraced public-private bike sharing partnerships (e.g., CitiBike, Ford GoBike). The U.S. trend toward e-bike dominance, corporate sponsorships, and station-less models mirrors the path Sweden is following.

Additionally, American cities are integrating bike sharing into larger climate and equity initiatives, targeting underserved communities. Sweden can capitalize on this experience by adopting inclusive pricing models and focusing on bike accessibility in low-income zones.

Germany:

Germany’s well-developed cycling culture and regulated bike-sharing market closely resemble Sweden’s environment. Cities like Berlin and Hamburg have successfully implemented multi-operator ecosystems, blending docked and dockless models under unified regulatory frameworks. Germany also excels in data-sharing mandates, promoting transparency and better fleet management—an area where Sweden can further enhance its strategy.

Germany’s experience with e-bike expansion and vandalism control technologies also provides insights for Sweden’s operators, especially as fleet sizes grow.

5. Commutator Analysis (Competitive Landscape)

The Sweden Bike Sharing Market includes a mix of local startups, multinational providers, and municipality-run systems, creating a healthy competitive environment that fosters innovation and service improvement.

Major Players:

Voi Technology

Nextbike

Donkey Republic

Tier Mobility

Lime

Cykelpoolen

UbiGo

Stockholm e-bikes (City-run)

Voi Technology:

A major Swedish mobility tech firm, Voi has recently expanded into shared e-bikes, adding to its successful e-scooter operations. It’s partnering with several municipalities to integrate bikes into public mobility planning tools.

Donkey Republic:

Operating across Europe, Donkey Republic provides dockless bike services in multiple Swedish cities. The company focuses on subscription-based rental models and is known for affordable pricing and reliable fleet tech.

Nextbike:

Though primarily strong in Germany, Nextbike has expanded its Scandinavian footprint and offers hybrid bike-sharing systems. It collaborates closely with transit authorities to integrate with bus and train ticketing.

Lime and Tier Mobility:

These micromobility giants have included Sweden in their e-bike rollout. With a focus on urban centers, they bring experience from larger international markets, offering advanced fleet management, carbon offset programs, and rider education campaigns.

UbiGo:

A Swedish MaaS startup, UbiGo offers bundle mobility packages that include bike-sharing as part of integrated city travel. It’s helping reshape how urban Swedes view daily commutes.

Key Strategies in Play:

Expansion into university towns and Tier-2 cities

Piloting AI-powered predictive maintenance

Introducing loyalty rewards and gamified fitness incentives

Collaborating with urban planners on bike lane network expansion

6. Conclusion

The Sweden Bike Sharing Market is on an exciting growth trajectory, projected to reach USD 107.42 Million by 2030, powered by innovation, sustainability goals, and urban lifestyle shifts. As climate consciousness becomes mainstream and active mobility earns public trust, bike sharing is evolving into an indispensable urban utility.

With strategic investments in infrastructure, technology, and inclusive services, Sweden has the opportunity to become a European benchmark for sustainable urban mobility. As players like Voi, Lime, and Donkey Republic drive digitization, and government policies create a conducive regulatory environment, the sector is ripe for transformation.

About Us:

Stellar Market Research is a leading India-based consulting firm delivering strategic insights and data-driven solutions. With 119 analysts across 25+ industries, the company supports global clients in achieving growth through tailored research, high data accuracy, and deep market intelligence, serving Fortune 500 companies and maintaining strict client confidentiality.

Address

Phase 3, Navale IT Zone, S.No. 51/2A/2, Office No. 202, 2nd floor, Near, Navale Brg, Narhe, Pune, Mahara****ra 411041

Email

sales@stellarmr.com

Mobile

+91 9607365656